Switch Market Survey: 5 out of 6 Key Measures Improved in Nov. 2020

02/15/2021 //

My November 2020 survey of the switch market shows five of six measures are improving. All six are stronger than the previous month.

Nov. 2020 Switch Market Conditions Summary

|

Index |

Direction |

Change vs. Previous Month |

New orders last month |

0.800 |

Improving |

Stronger |

New orders last month |

0.600 |

Improving |

Stronger |

Shipments last month vs. previous month |

0.400 |

Improving |

Stronger |

Shipments last month vs. same month last year |

0.400 |

Improving |

Stronger |

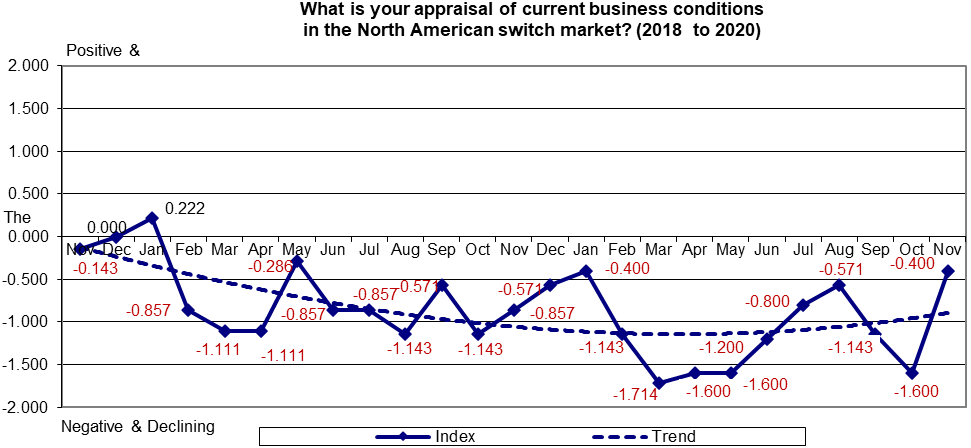

Current business conditions |

-0.400 |

Declining |

Stronger |

Expected business conditions in 6 months |

0.800 |

Improving |

Much Stronger |

The Institute of Supply Management’s manufacturing PMI for December was 60.7, up from 57.5 in November. New orders were 67.9 increasing from 65.1 the previous month. The employment index was 51.5 down from 48.4 in October. The Price Index was nearly unchanged at 77.6 from 65.4 the previous month.

Sixteen of eighteen industry segments reported growth in October, with significant switch users in the Computer & Electronic Products; Machinery; and Electrical Equipment, Appliances & Components segments.

New orders for manufactured durable goods in November increased 0.9 percent, according to the U.S. Census Bureau. This increase followed a 1.8 percent rise in October for seven consecutive months of increase. The Bureau of Labor reported 140,000 jobs lost in December and the unemployment rate was 6.7 percent.

Month-over-month new orders jumped back to a level last seen in the summer. Compared to the year before, orders jumped above zero for the first time since March.

Compared to the prior month, sales were above zero and near a one-year high. Sales compared to the same month last year were also positive and near a yearly high.

Current business conditions reached their best levels since the prior year. Expectations for the future are back above zero and at a one-year peak.

November’s survey question concerning a forecast for the 2020 North American switch market yielded the following results:

Percent Change |

Percent of Respondents |

Previous Month |

Up >5% |

0% |

0% |

Up 1-5% |

13% |

0% |

Unchanged |

0% |

19% |

Down 1-5% |

0% |

19% |

Down >5% |

87% |

62% |

When asked about recession in the United States, 63 percent of respondents thought we are in a recession, with another 37 percent believing a recession is coming; none believed a recession will be avoided.

The coronavirus pandemic has caused many businesses to slow or close operations. The following shows the percent of respondents stating their customers’ and their company’s percentage of normal operations:

Percent of Normal Operations |

Customers |

Company |

25% |

0% |

0% |

50% |

0% |

0% |

75% |

84% |

84% |

100% (Normal) |

16% |

16% |

Potential Effects On The Switch Market

Quick resolution of the Covid-19 pandemic was the most frequent response when asked about positive impacts on the switch market. The rebuilding of infrastructure, capital and military spending, as well as a weakening dollar were also mentioned.

A prolonged effect of the Covid-19 pandemic was the biggest concern for the switch market. The expansion of touch-screens, voice recognition, sensors and a strengthening dollar were also mentioned as negative for the switch market.

Statements of fact and opinions expressed in posts by contributors are the responsibility of the authors alone and do not imply an opinion of the officers or the representatives of TTI, Inc. or the TTI Family of Companies.

Michael Schwert

Michael is the founder of Cumulus, Inc. He has more than 30 years of marketing and sales as well as design experience in the electronic and electrical component industry. Prior to founding Cumulus, he was Director of Marketing for Cherry Electrical Products and held other marketing management positions with Panduit, BRK Electronics, and Ideal Industries.

Cumulus provides market information and consulting services for the global electronic components industry. The company offers three publications: Switch Tracks, a quarterly report with market information on component switches; the Relay Report, a quarterly report with market information on component relays; and Market Notes, a monthly report on sales, bookings, and business conditions in the relay and switch market. Cumulus also manages projects that help leading global suppliers in the relay and switch industry to develop new products and reach new markets.

Schwert provides MarketEYE with monthly articles that include timely and accurate market information for the electromechanical component sector of the electronics industry.