Global Market Update – Capacitor Lead Times: October 2025

11/05/2025 //

CAPACITOR LEAD TIME UPDATE

If you're responsible for sourcing capacitors in late 2025, you're facing one of the most challenging procurement environments in the history of the electronics industry. Our latest data through October 2025 shows that average lead times across all capacitor technologies have reached 19.07 weeks – showing signs of increasing for many parts after decades of turbulence.

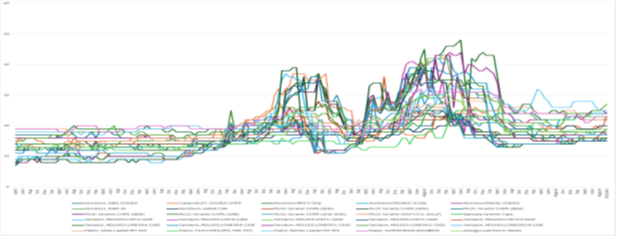

Capacitor Lead Times by Type and Configuration (29 Types of Aluminum, Ceramic, Tantalum and Plastic Film Capacitors): April 2012-October 2025

Source: Paumanok Publications, Inc. – Lead Time Analysis for Selected Capacitor Types (2012-2025) – A Paumanok Publications Market Intelligence Report

The overall data shows that after a decade of turbulent lead time activity, the market stabilized at a new level, which, as of October 2025, was about 46% higher than pre-pandemic normalcy. The dielectrics with the most active lead time trends include aluminum electrolytic and plastic film capacitors, while tantalum and MLCC remain stable.

WHERE WE ARE: OCTOBER 2025 SNAPSHOT

The Overall Picture

Our composite lead time index tracks 29 different capacitors by type and configuration monthly. Here's what the data shows:

| Metric | October 2025 | Pre-Pandemic (2012-2019) | Change |

| Average Lead Time | 19 weeks | 13 weeks | +46% |

The Capacitor Technologies in Movement

Not all capacitors are equally constrained. Here's the breakdown by severity:

MARKET WATCH (25-27 weeks):

- Aluminum Snap-In: 27 weeks ← Growing Fast

- Plastic PET Radial Leaded: 25 weeks ← Consistent

MARKET ACTIVITY (20-24 weeks):

- Aluminum SMD V-Chip: 24 weeks

- Aluminum Organic H-Chip: 23 weeks

- Film Chips (PEN, PET, PPS): 23 Weeks

- Plastic Snubber (X/Y): 23 Weeks

- Aluminum Axial Leaded: 22 weeks

- Aluminum Radial: 22 weeks

ELEVATED BUT MANAGEABLE (<20 weeks):

- All MLCC Sizes: 15-17 weeks

- Tantalum All Sizes: 15-17 weeks

WHAT IS CHANGING

The 2020-2021 shortage was driven by identifiable external shocks: factory closures, logistics collapse and panic ordering. Those factors have been resolved. Now the market is beginning to gain momentum in areas where inventories are growing thin, especially in computing and automotive end markets.

1. Artificial Intelligence and Data Centers

- Every AI server requires 5,000-10,000 MLCC and 300-600 aluminum polymer capacitors

- Hyperscalers (AWS, Azure and Google) building unprecedented data center capacity

- Impact: Aluminum polymer SMD as noted in graphic above

2. Electric Vehicle Revolution

- EVs require 10,000-22,000 capacitors vs. 2,000-3,000 in traditional vehicles

- Global EV production: 18M units in 2025, projected 45M by 2030

- 48V mild-hybrid systems proliferating

- Impact: Tantalum, aluminum radial and MLCC across all sizes

3. Renewable Energy Infrastructure

- Solar/wind installations growing 20-30% annually

- EV charging stations deploying globally (each station: $400-800 capacitor content)

- Grid modernization requiring massive power electronics

- Impact: Film capacitors, aluminum snap-in and power-grade MLCC

4. Industrial Electrification

- Motor drives, automation equipment and robotics

- Replacing hydraulic/pneumatic systems with electric

- Variable frequency drives proliferating

- Impact: aluminum radial/snap-in, industrial MLCC and film capacitors

WHY CAPACITY ISN'T KEEPING UP

You might ask, "Why don't manufacturers just build more capacity?" There are three reasons:

1. Long Investment Cycles

- New MLCC or tantalum facility: 18-36 months from decision to production (Paumanok studies on both)

- Equipment lead times themselves extended (furnaces and kilns)

- Workforce training requirements (unique manufacturing, high volume and multiple disciplines)

- By the time capacity arrives, demand has grown further (stacking, winding and porous anode developments in nanotechnology)

2. Technology Barriers

- Advanced components (aluminum polymer, high-CV MLCC and low-ESR tantalum) require specialized expertise

- Few manufacturers can produce these technologies

3. Raw Material Constraints

- Tantalum: conflict mineral stigma and associated legal requirements

- MLCC ceramic dielectric materials: additives include neodymium, yttrium, and others

- Aluminum ores and concentrates: market shifts over government involvement

- Plastic dielectrics: dispersing into multiple solutions for new electric opportunities

WHAT HAPPENS NEXT: SCENARIO PLANNING

Paumanok Base Case: "Plateau, Gradual Increase" (50% Probability)

Assumptions

- AI/HPC demand continues strong growth

- EV adoption reaches 25-30% global share by 2027

- Announced capacity additions come online 2026-2027

- No major recession or geopolitical disruption

Forecast

- Q4 2025 - Q2 2026: lead times hold at 19 weeks (current plateau)

- Q3 2026 - Q4 2026: modest improvement to 20 weeks

- 2027: Gradual increase to 22 weeks

Reality: Lead times remain 45-50% above pre-pandemic through 2027.

Paumanok Publications, Inc. is the world's largest supplier of market research and consulting services to the passive electronic component industry. For 38 years, Paumanok has supplied research products and services for trade companies and private equity firms that have a financial interest in or are directly involved in the supply chain for capacitors, resistors, inductors and circuit protection components as well as the engineered materials and ores associated with their key functions.

Follow TTI, Inc. on LinkedIn for more news and market insights.

Statements of fact and opinions expressed in posts by contributors are the responsibility of the authors alone and do not imply an opinion of the officers or the representatives of TTI, Inc. or the TTI Family of Specialists.

Follow TTI, Inc. - Europe on LinkedIn for more news and market insights.

Statements of fact and opinions expressed in posts by contributors are the responsibility of the authors alone and do not imply an opinion of the officers or the representatives of TTI, Inc. or the TTI Family of Specialists.

Dennis M. Zogbi

Dennis M. Zogbi is the author of more than 260 market research reports on the worldwide electronic components industry. Specializing in capacitors, resistors, inductors and circuit protection component markets, technologies and opportunities; electronic materials including tantalum, ceramics, aluminum, plastics; palladium, ruthenium, nickel, copper, barium, titanium, activated carbon, and conductive polymers. Zogbi produces off-the-shelf market research reports through his wholly owned company, Paumanok Publications, Inc, as well as single client consulting, on-site presentations, due diligence for mergers and acquisitions, and he is the majority owner of Passive Component Industry Magazine LLC.