High-Reliability Passive Electronic Components: 2025 World Markets and Technologies

08/07/2025 //

INTRODUCTION

We estimate the global core passive component spend for high-reliability applications is worth approximately $1.3 billion worldwide for 2025, supporting a $6.5 billion active component market. These include ceramic, tantalum, aluminum, plastic film carbon and hybrid dielectric capacitors; ruthenium, tantalum nitride, tin oxide, carbon and nickel chromium resistors; ferrite beads, ferrite cores, ceramic chip coils, axial and radial micro-inductors; and circuit protection components such as fuses, thermistors, varistors, silicon avalanche diodes, gas discharge tube arresters and related ESD suppression components.

Each of these components has its own exotic raw materials supply chains that mirrors the increasing complexity of advanced electrical and electronic platforms requiring high-reliability support on a global basis.

HIGH-RELIABILITY PASSIVE COMPONENT PRODUCTS BY DEFINITION

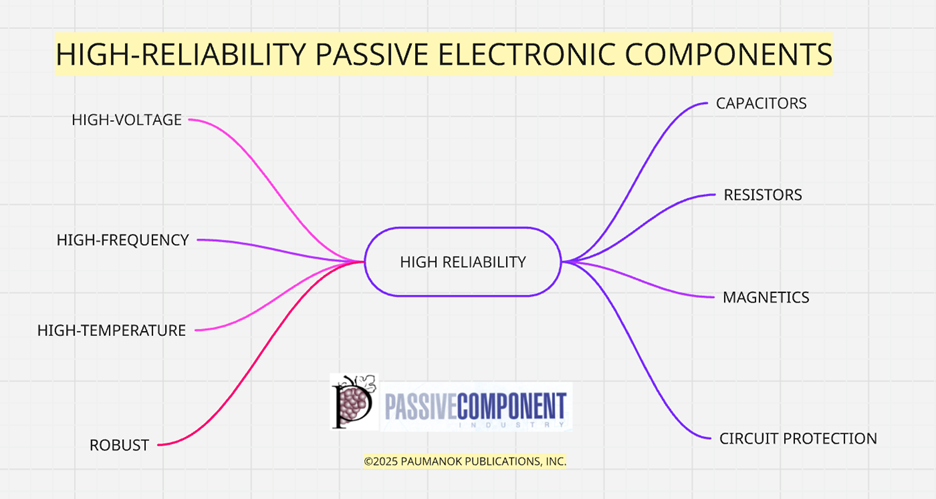

The following chart illustrates how passive components, with emphasis upon capacitors, resistors, inductors and circuit protection components, are all required in high-reliability segments of the global market. In addition to basic passive functions in a circuit, such as providing capacitance, resistance, inductance and overvoltage and overcurrent protection, these components are also subjected to additional stimuli that requires a robust design, adding value by engineering the component to operate at increasingly higher voltages, frequencies and temperatures.

Figure 1: High-Reliability Passive Components: The Sweet Spot in Profitability

Derived from Dennis Zogbi’s “High-Reliability Passive Electronic Components: Worth Markets, Technologies and Opportunities” – Paumanok Publications, Inc. www.paumanokgroup.com

THE NEED FOR PASSIVES IN MISSION CRITICAL MARKETS

Capacitance, resistance, inductance and circuit protection are required in almost all electronic circuits and are fundamental to electrical and electronic system architectures. Mission critical end-markets are no exception to this rule, and this places strategic importance on key parts in the application-specific and mission-critical parts ecosystem.

To satisfy the demand for capacitance and resistance, the primary components consumed are the multilayered ceramic chip capacitor and the ruthenium thick film chip resistor. All other passive components, including tantalum, aluminum, plastic film, nichrome, carbon, tin oxide and various types of mixed metal oxides (MMOs), find their way into high-reliability supply chains because of the precise nature of specific components and their known reliability in harsh and demanding environments.

WHAT QUALIFIES AS HIGH RELIABILITY?

The following criteria are used to determine the differences between mass commercial markets for passive electronic components and their high-reliability passive components counterparts. It is a simple technical-economic comparison of channel requirements to compete.

End-Market Considerations

End-markets into which high-reliability passive components are consumed include aerospace/defense/satellite, medical implants, medical test and scan, downhole pump, downhole logging tools, radar pulse forming networks, TV transmitters, welding equipment, munition electronics, undersea cable repeaters, semiconductor RF sputtering devices and optical networking infrastructure devices.

Figure 2: The Five Sub-Categories of High-Reliability Ecosystems

Derived from Dennis Zogbi’s “High-Reliability Passive Electronic Components: Worth Markets, Technologies and Opportunities” – Paumanok Publications, Inc.

Volume and Value Considerations

High-reliability passive components are dominated by low-volume, high-priced parts. Price is considered secondary to product performance when it comes to high-reliability capacitors, resistors, inductors and circuit protection designs.

Operating Margin Considerations

The operating margins associated with high-reliability passive components are among the highest in the industry.

Price Stability

Price volatility is typically not an issue in high-reliability passive component markets because price is secondary to product performance, unlike the mass commercial markets where price volatility is rampant and quarterly price reviews are not uncommon. Downward price pressure in the mass commercial markets is generally accepted as the norm, whereby such volatility is not generally present in the high-reliability component ecosystems.

End-Product Lifecycle Considerations

The lifecycle of the end-product into which the high-reliability passive components are sold is also a consideration. In general, the life expectancy of high-reliability passive components end-products is 5 to 10 years, while the lifecycle of mass commercial products is one to three years.

Performance Driven Product Considerations

Another consideration is that high-reliability passive components are sold to customers based upon their performance criteria and their inherent and expected quality, while mass commercial products are sold in large volumes to satisfy a much larger population.

Regional Market Considerations

High-reliability passive component markets remain largely in the United States, France, the UK, Germany, China, Korea, Israel, Sweden, Italy and Japan, with the rest of the world as emerging markets for producing these advanced parts.

Competitive Environment Considerations

Another consideration is that high-reliability passive component vendors are generally smaller mom and pop-type manufacturers that specialize in a specific field or fields of expertise, such as high-voltage products, high-frequency products or high-temperature products. These typically have years of experience and subsequent “sticky” customer relationships that defy traditional channels of business and remain highly profitable and coveted segments of the supply chain (the greenest part of the ecosystem).

HIGH-RELIABILITY COMPONENTS: OVERLAPPING TECHNOLOGY REQUIREMENTS

High-reliability passive components offer some intrinsic value based upon their structure, which includes their ability to operate at high voltages, at high frequencies or in high-temperature or robust environments. Sometimes these criteria overlap, whereby a capacitor may be required to operate at high voltage and high frequency (i.e. MRI equipment) or at high voltage and high temperature (defense related circuits or some downhole pump or geothermal circuits).

It is this combination of multiple requirements that increases the price and profitability of these components accordingly. Also, it has been determined during the course of this project where high voltage and high frequency and/or high temperature requirements are combined together (especially in oil well services industries, defense electronics and medical electronics), the prices are especially high and the margins substantially exceptional for the finished products.

Additional premiums can also be gained by the component vendor if the passive component has unusual voltage, capacitance value or capacitance change with temperature requirements or should it require an unusual electrode or termination material (i.e. platinum or gold) or an unusual termination type (such as polymer flexible termination).

Importance of Customer Relationships and Vendor Responsiveness

It is also important for readers to understand the importance of personal customer relationships in the high-reliability passive component market segment. Since the number of specialty customers requiring these components is limited, it is important to emphasize that certain individual salespeople in the field have been known to move from brand to brand within the segment and literally take large customer bases with them in the process because of personal loyalty between customer and salesperson. This is very common in oilwell [LM1] services, aerospace, satellite and medical segments of the high-reliability end-markets.

HIGH-RELIABILITY MARKET SEGMENTS IN ELECTRONIC COMPONENTS

High-Voltage Segment

High-voltage passive component products include chips, axial and radial leaded designs, single layered discs and “doorknob type” robust components. Prices are high and determined by the higher priced doorknob capacitors consumed up to the 100kV range. The largest application is the power supply which required capacitors, resistors, inductors and circuit protection for input/output filtering circuits and are fundamental to the power supply, converter and inverter architectures and the entire sub-assembly may be exposed to high temperatures and harsh mechanical and physical environments based upon altitude, depth and rapid-on/off cycling.

High-Frequency Segment

High-frequency passive components include both thick and thin film designs, as well as multilayered and single layered configurations. Ceramic-based passive components are favored in these circuits for their farad and ohmic stability at high frequencies. Applications include communications infrastructure, RF sputtering, transmitters, radar, lab test equipment and medical imaging devices and specialty feedthrough EMI filters.

High-Temperature Segment

High-temperature circuits are challenging environments for component manufacturers because of the tendency for capacitance, resistance and inductance to change with applied temperature, thus impacting the fundamental function of the component in the circuit. Specific types of plastic film capacitors are preferred in this environment because of their self-healing capabilities, but solid-state dielectrics such as tantalum and ceramics thrive here because of their inherent robust nature. High-temperature ecosystems intersect above 200°C into space, defense and oil and gas electronics, including downhole pumping and logging tools.

SUMMARY AND CONCLUSIONS

Component manufacturers are currently moving toward more “conviction-related” investments and supply chains. In order to capitalize on this, vendors are refocusing their efforts on high-reliability type passive components, where pricing is secondary to component performance and reliability.

These components are fundamental to the circuit assembly and include capacitors, resistors, inductors and circuit protection components and are determined based upon the high-voltage, high-frequency, high-temperature and/or robust nature of the component requirement. End-markets where mission critical and application specific circuits can be found include defense, space, civil aviation, medical, oil & gas, infrastructure and advanced industrial circuits and represent the leading edge of advanced technology in 2025.

Paumanok Publications, Inc. is the world's largest supplier of market research and consulting services to the passive electronic component industry. For 36 years, Paumanok has supplied research products and services for trade companies and private equity firms that have a financial interest in or are directly involved in the supply chain for capacitors, resistors, inductors and circuit protection components as well as the engineered materials and ores associated with their key functions.

Follow TTI, Inc. on LinkedIn for more news and market insights.

Statements of fact and opinions expressed in posts by contributors are the responsibility of the authors alone and do not imply an opinion of the officers or the representatives of TTI, Inc. or the TTI Family of Specialists.

Follow TTI, Inc. - Europe on LinkedIn for more news and market insights.

Statements of fact and opinions expressed in posts by contributors are the responsibility of the authors alone and do not imply an opinion of the officers or the representatives of TTI, Inc. or the TTI Family of Specialists.

Dennis M. Zogbi

Dennis M. Zogbi is the author of more than 260 market research reports on the worldwide electronic components industry. Specializing in capacitors, resistors, inductors and circuit protection component markets, technologies and opportunities; electronic materials including tantalum, ceramics, aluminum, plastics; palladium, ruthenium, nickel, copper, barium, titanium, activated carbon, and conductive polymers. Zogbi produces off-the-shelf market research reports through his wholly owned company, Paumanok Publications, Inc, as well as single client consulting, on-site presentations, due diligence for mergers and acquisitions, and he is the majority owner of Passive Component Industry Magazine LLC.